The Great Depression, initiated in the United States in 1929 and spread worldwide, stands as the most extended and severe economic downswing in modern history. Characterized by substantial reductions in industrial production, deflation, extensive unemployment, banking crises, and a surge in scarcity and homelessness, its impact was far-reaching.

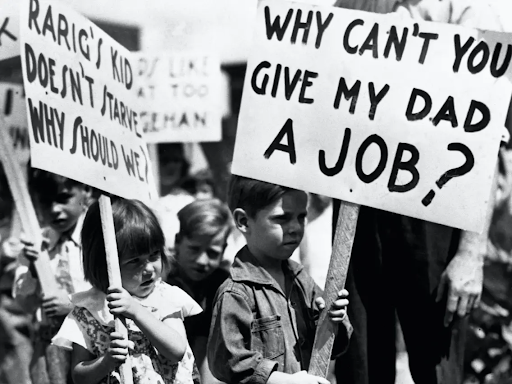

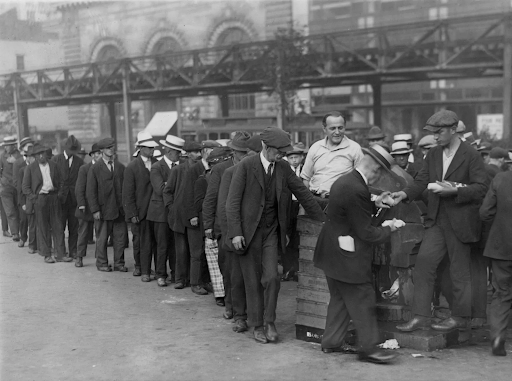

The Great Depression smashed countries with market economies in the late 1920s. It had varying degrees of rigidity across different nations. In the United States, it reached its lowest point in 1933, with a surprising 25 percent unemployment rate for all laborers and 37 percent for nonfarm workers. This period was distinct by broad distress, including hunger, loss of homes, and beggary.

Key Factors Intensifying the Great Depression

Three key factors played varying roles in the development and reinforcement of the Great Depression:

- The collapse of the stock market in 1929 played a key role in deteriorating confidence in the American economy. The sudden collapse of stock prices led to an intense reduction in customer and business expenditure, as well as a decrease in investment.

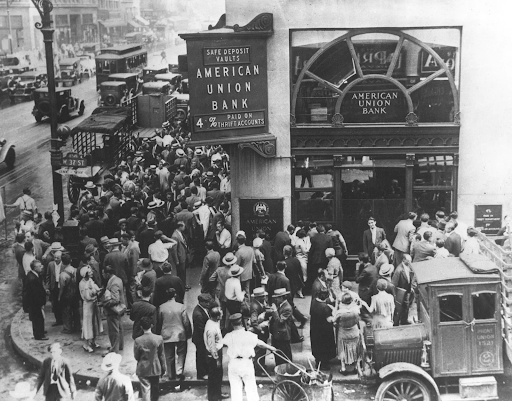

- The early 1930s caused extensive banking panics, causing countless banks to fail. This had a severe impact on the accessibility of funds for loans, leading to a compaction in credit and a further decline in economic activity.

- Legislated in 1930, the Smoot-Hawley Tariff Act set high tariffs on a wide range of industrial and agricultural products. This protective step invited retributory actions from other nations, initiating a reduction in output and a contraction in global trade. The trade obstacles set off a disastrous cycle, aggravating the economic downturn.

These factors collectively created a terrific storm, heightening the economic difficulties faced by individuals and nations. The Great Depression had deep and lasting effects, transforming economic thinking, reshaping the role of government in the economy, and influencing policy decisions for decades to come.

Impacts, Government Intervention, and Economic Legacy

The Great Depression led to a substantial change in the federal government’s role in the U.S. economy. It encouraged the government to take charge of the elderly community through Social Protection and provide unemployment settlement for those instinctively unemployed. The Wagner Act also played a key role by enabling labor unions and fair labor contract discussions, increasing the size and power of the federal government.

During the 1930s, the federal state considerably expanded, with a significant rise in paid civilian employees. Federal revenue and expenditures as a percentage of Gross National Product (GNP) also flew, reflecting the government’s growing role.

This duration also seriously impacted economic consideration, as many economists ascribed the depression to deficient demand. The Keynesian view, supporting government intervention to equalize demand and prevent future depressions, became supreme for several decades, though it has faced some problems in recent years.

The Great Depression’s reasons remain a matter of debate among economists, with varying beliefs on why it began in the late 1920s lasted longer, and was more severe in some areas, particularly the United States. One influential factor was the international gold standard, which economically connected many countries together. The need for gold and efforts to repay the gold standard played a role in activating the depression.

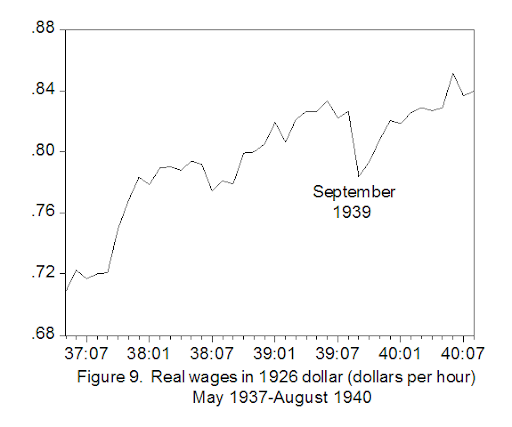

In the United States, the depression lasted for several years, with a long compacting phase that saw severe drops in GNP and price levels. Unlike prior depressions, wage rates stayed relatively constant, which led to real hourly wage increases and across-the-board releases in the industry sector.

President Herbert Hoover’s policies, including high wage rates, applying the Smoot-Hawley Tariff, and discouraging wage cuts, contributed to the economic challenges. The financial sector also encountered problems, with bank runs and collapses causing a substantial decline in the money supply.

President Franklin D. Roosevelt’s New Settlement presented different policies intended for recovery, but some, like the Agricultural Adjustment Act and the National Recovery Administration, had unintentional effects, lowering production and employment. The Supreme Court later ruled the NRA unconstitutional.

The economy did not fully rescue until the late 1930s, with factors like labor cost expansions, monetary policy shifts, and administration uncertainty blocking the recovery process. The eruption of World War II is often attributed to finally ending the Great Depression, although this view has been debated.

In conclusion, while another Great Depression is unlikely due to enhanced economic policies and lessons learned, the impact of the Great Depression on economic consideration, government intrusion, and fiscal and monetary policies continues to influence economic policy decisions today.